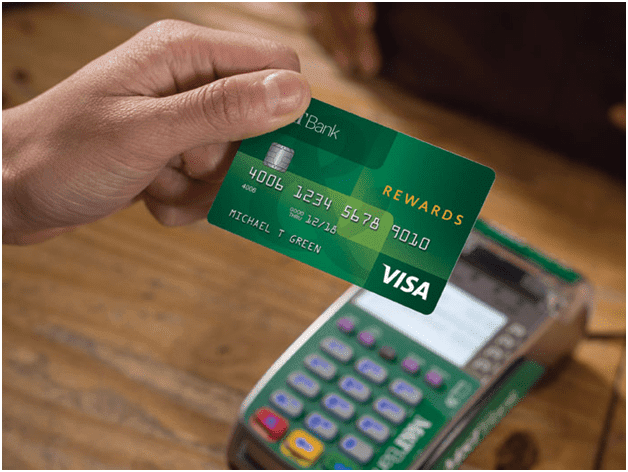

Merchant Account Providers for Small Business and Security Resources

On Thursday, 4 August 2016, at 10 a.m. Pacific time, Visa will host a webinar to review newly published PCI Security Standards Council resources designed to help small high risk business process payments securely.The PCI Security Standards Council convened a small merchant business task force to provide guidance and feedback to prepare resources that simplify data security for some of the most vulnerable businesses preyed upon by cyber criminals. Relying on cross-industry expertise to help small merchants understand why and how to protect payment card data and resolve risks to their businesses the task force has developed the following resources: A guide to safe payments Payment diagrams Questions to ask your vendors A glossary of payment and information security terms. Visa is committed to protecting the payment system. As part of this commitment, Visa regularly posts data security communications on their website. Webinar: PCI Council Publishes Small Merchant Securi